Costco has long been a model of ethical capitalism—a place where families shop in bulk and members feel like insiders. As an Executive Member myself, I’ve trusted the brand not just for its value, but for its values. CEO Ron Vachris has publicly emphasized Costco’s commitment to improving the “front-end experience” and preserving the company’s legendary culture. And yet, beneath the surface, a disturbing contradiction lurks.

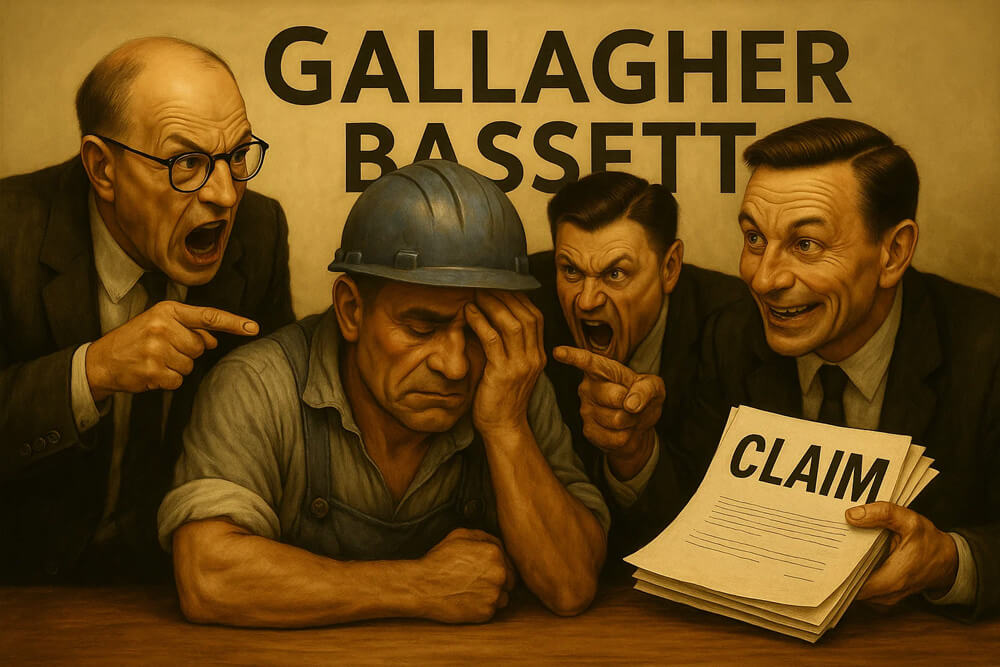

That contradiction is Gallagher Bassett.

Costco, a self-insured company, has outsourced its liability claims to Gallagher Bassett Services, a third-party administrator (TPA) known not for customer care—but for callous stonewalling, lowball settlements, and silence in the face of legitimate claims. For members unlucky enough to experience an incident—say, a Costco employee accidentally damaging their vehicle—this partnership can feel like betrayal.

What Is a TPA—and Why It Matters

Gallagher Bassett isn’t an insurance company. It’s what’s known as a Third-Party Administrator (TPA)—a firm hired by self-insured companies like Costco to handle liability claims on their behalf.

In plain terms: instead of dealing with an insurance carrier, members file claims through a company whose job is to protect Costco’s financial interests—not to advocate for the customer. TPAs like Gallagher Bassett are paid to investigate incidents, minimize payouts, and close claims quickly and cheaply.

For most Costco members, this setup is invisible—until something goes wrong. Then the friendly warehouse brand vanishes, and members are left dealing with a claims handler whose loyalty is to Costco’s bottom line, not the customer’s experience.

Gallagher Bassett: A Track Record of Denial

Gallagher Bassett’s reputation is no secret. They manage liability claims for large, self-insured entities—from corporations to school boards to churches. But according to the law firm Miller & Zois, which specializes in injury cases, GB has a well-earned reputation for “lowball offers,” “denying valid claims,” and wearing down claimants through “delays and deflection.”

Consumer complaints across platforms like ComplaintsBoard and PissedConsumer paint a grim picture:

- Claims routinely ignored for weeks or months

- Adjusters failing to return calls or acknowledge documentation

- Valid cases closed without explanation

In one case, a Texas jury found Gallagher Bassett guilty of violating the state’s Deceptive Trade Practices Act, awarding $1.7 million to a wronged claimant. This isn’t a one-off—it’s a pattern.

A Conflict Between Stated Values and Member Experiences

Costco’s own Code of Ethics places a heavy emphasis on member satisfaction. As outlined on its investor website:

“Take care of our members. Our members are our reason for being – the key to our success. If we don’t keep our members happy, little else that we do will make a difference.”

Costco pledges to provide “100% satisfaction” and “the best customer service in the retail industry.” These aren’t vague aspirations—they’re foundational commitments that drive Costco’s brand loyalty.

Yet, the experiences of members forced to deal with Gallagher Bassett contradict these values. Long delays, ignored calls, and denied claims don’t just violate expectations—they violate trust. Gallagher Bassett’s behavior stands in sharp contrast to Costco’s stated mission, and the silence from Costco leadership on this matter is difficult to reconcile with its promise to treat members as “our guests.”

A Personal Note

This issue became personal for me when a Costco employee caused damage to my vehicle in the parking lot. The incident was acknowledged on-site, and I was directed to file a claim through Costco’s third-party handler, Gallagher Bassett. What followed was months of delays, unreturned calls, and frustration. Eventually, I had to escalate the issue through my own insurance provider. To this day, the claim remains unresolved. That experience opened my eyes to a side of Costco that most members never see—and prompted me to investigate further and speak out.

Why This Matters

Most Costco members have no idea who Gallagher Bassett is—until they need them. Then they discover the black hole where accountability should be.

There’s no mention of Gallagher Bassett on Costco’s website. No member guidance. No ombudsman. When something goes wrong, members are essentially handed off to a claims gatekeeper trained to minimize liability, not ensure justice.

This isn’t just bad optics—it’s a failure of corporate integrity.

What Costco Should Do

Costco can—and should—lead by example:

- Terminate the partnership with Gallagher Bassett.

Replace them with a firm that operates with transparency and fairness—or better, bring claims handling in-house where Costco can be held directly accountable. - Establish a Member Claims Ombudsman.

A neutral party who can fairly adjudicate disputes would restore trust and likely reduce the legal escalation that GB’s practices often provoke.

A Message to Ron Vachris

Mr. Vachris, your story—from warehouse worker to CEO—is inspiring. But leadership is more than origin stories and earnings calls. It’s about aligning every corner of your company with the values you claim to uphold.

Ending your contract with Gallagher Bassett would send a message loud and clear: that Costco doesn’t just talk about ethics—it lives them.

Until then, I urge fellow members to share their own experiences publicly. Tag @Costco and @RonVachris. Ask questions. Demand accountability.

Because a brand that prides itself on doing the right thing—shouldn’t outsource doing the wrong thing.

—Wolfshead

Sorry to hear that you didn’t get justice and compensation!

Such companies are known to do their “job” and in their and often their client’s view as well this is simply to avoid paying anything, with questionable and in your case I would even call it simply illegal methods.

Costco should indeed end this business relationship. One cannot claim innocence when hiring such a company.